Home | Sustainable Companies to Invest In | 809% ROI Returns – PPS

Home | Sustainable Companies to Invest In | 809% ROI Returns – PPS

The global EO sterilization market is projected to expand from $6.05 billion in 2025 to $16.78 billion by 2035 (CAGR: 10.73%)—creating a rare opportunity for investors seeking ESG-aligned clean technology solutions with proven commercial viability.

$5-8M unlocks $50M+ revenue in 5 years

EPA 2024 rules demand urgent compliance

Validated sites prove market viability

EaaS supports fast growth to 100+ sites

Strong buyout interest from top industrials

| Metric | Pure Prime Solutions | TAS | BOAZ |

|---|---|---|---|

| Recovery Rate | Near 100% | 90% | 0%* |

| Emissions Reduction | 99.99% | 90% | 99.99%+ |

| Annual Cost Savings | $1M/year | $500K/year | $300K/year |

| Business Model | EaaS (subscription) | Traditional | Traditional |

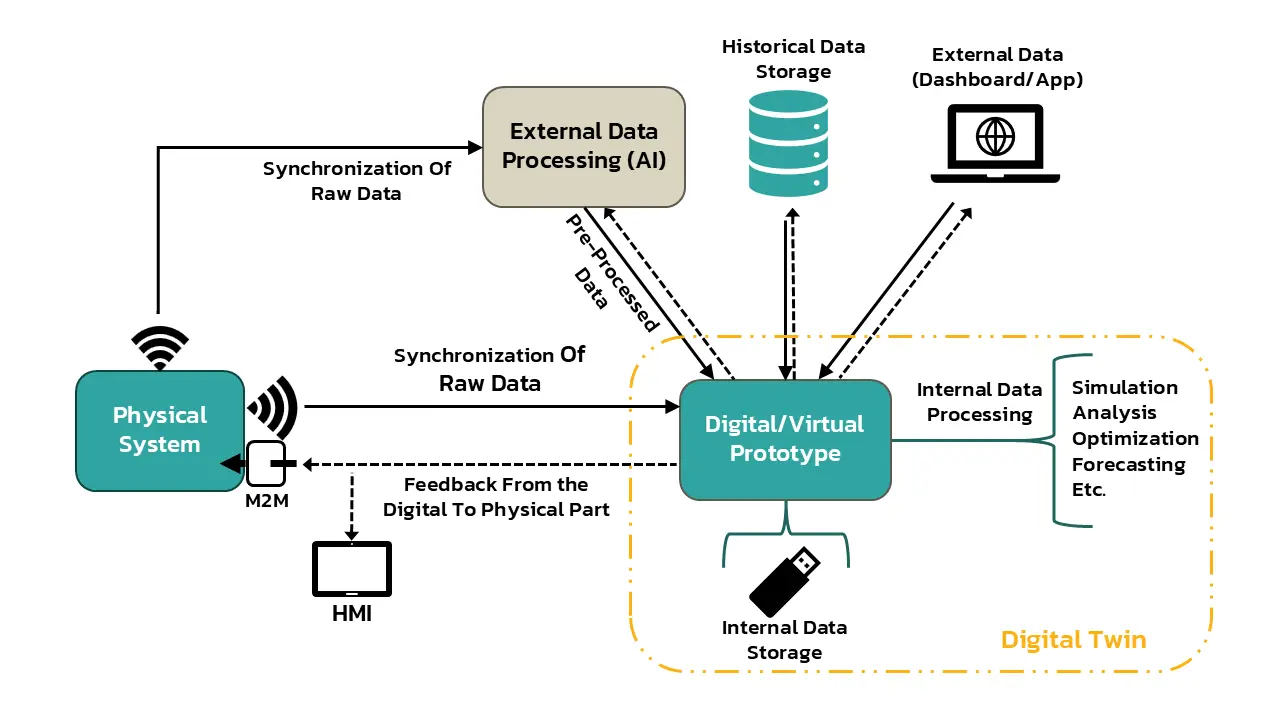

| Digital Twin Integration | Advanced | Limited | None |

*LESNI uses destruction, not recovery. **Achieved via destruction, not reuse.

Only cleantech solution capturing complete value through env engineering

Industrial automation and digital engineering drive immediate savings

Environmental engineering serves 10-bed to 1000-bed facilities efficiently

Real-time value engineering optimization with predictive maintenance

Protected by US 10,738,020 B2, US 10,815,209 B1, and 8 international patents

Near-Term (1-2 Years) – Pilot clean technology implementations and secure additional sustainable engineering patents.

Mid-Term (3-5 Years) – Deploy next-generation environmental engineering enhanced by AI-driven industrial automation.

Long-Term (6+ Years) – Establish as the cleantech industry benchmark, targeting strategic exits valued at $100M+.

This not only jeopardizes operational efficiency but also undermines potential gains in the rapidly expanding EO sterilization sector, expected to grow from $5.47 billion in 2025 to $16.78 billion by 2035 (10.7% CAGR).

Pure Prime Solutions offers a game-changing solution: our patented EO recovery system achieves nearly 100% ethylene oxide recovery, cuts emissions by 99.99%, and delivers up to $1 million in annual savings per facility. With an 809% ROI, $16.76 million NPV, and a scalable EaaS model, PPS ensures profitability while supporting sustainable investing and environmental, social, and governance goals.

Achieving 99.99% emissions cuts with advanced EO recovery technology.

Delivering up to $1M in annual cost savings per facility

809% return on investment (ROI)

Achieve $16.76M NPV per facility through tailored, results-driven strategies.

EO sterilization market: $5.47B (2025) to $16.78B (2035), 10.7% CAGR.

Failure to embrace these changes threatens regulatory fines, higher costs, and market competitiveness as customers increasingly prioritize investing in sustainable companies and solutions.

Leverage our proprietary vapor recovery system—capturing nearly 100% of EO gas for reuse. Unlike competitors’ destruction-only methods, this ultra-clean tech delivers cost savings of $0.15-$1.35 per pound of EO while ensuring compliance with EPA, FDA, OSHA, and EU REACH standards—transition to truly sustainable manufacturing today.

In the medical device industry, EO sterilization is essential yet increasingly problematic. It’s the only viable option for sterilizing 50% of devices, but its environmental impact turns it into a regulatory and sustainability nightmare, threatening supply chains and compliance.

Without alternatives, manufacturers face mounting pressure from regulations and eco-conscious stakeholders. Delays in innovation could disrupt critical healthcare supplies, escalate costs, and hinder market growth—leaving billions in revenue at risk as the industry demands greener solutions.

Enter our groundbreaking clean technology, powered by advanced environmental engineering. It transforms EO from a liability into a sustainable asset, ensuring compliance while driving efficiency. The market is exploding to $16.78B through sustainable development, and Bayer Pharmaceuticals endorses our solution, stating it “ensures the future viability of the crucial healthcare supply chain.” Ready to future-proof your operations? Let’s connect today.

In the fast-paced cleantech sector, patents are the cornerstone of innovation protection, but they don’t last forever. With expirations on the horizon, companies risk losing their defensive moat, exposing proprietary technologies to imitation and eroding hard-earned market advantages.

Without a robust, enduring barrier, competitors can flood in, replicate your breakthroughs, and slash your pricing power. This leads to intensified rivalry, diminished profits, stalled growth, and potential obsolescence—turning years of R&D investment into vulnerabilities that could cripple your leadership in a market hungry for sustainable solutions.

Fear not: Our clean technology is fortified by a powerhouse patent portfolio, including US patents 10,738,020 B2 and 10,815,209 B1, with extensive international safeguards across Canada (CA3229924A1, CA3159301A1), the European Patent Office (EP4090653A4), United Kingdom (GB2606910B), Japan (JP7410302B2), Australia (AU2020423106B2, AU2022268302B1), and South Africa (ZA202205538B). Leveraging digital engineering for lasting efficiencies, plus a dynamic pipeline of new inventions, we ensure continuous innovation that extends far beyond current IP—securing your competitive edge indefinitely. Ready to fortify your future? Let’s discuss how.

High Emissions

Reduced Emissions

In the cleantech sector, especially for innovative solutions like Equipment as a Service (EaaS) in EO sterilization, there’s a common assumption that scaling requires enormous upfront capital—often $50M or more—to cover R&D, manufacturing, and market entry. This stems from traditional models burdened by high infrastructure costs, lengthy development cycles, and regulatory hurdles, making it seem impossible to launch effectively with leaner funding, such as $5M.

This inflated capital expectation creates barriers: it deters investors wary of long payback periods, stifles innovation by tying up resources in non-core areas, and exposes companies to financial strain from debt or dilution. Without a smarter approach, cleantech ventures risk stalled growth, missed market windows, and failure to capitalize on urgent demands for sustainable sterilization—potentially leaving billions in revenue untapped as regulations tighten and competitors surge ahead.

Dispel the myth: Our sustainable EaaS model transforms capital requirements through value engineering and strategic partnerships, enabling launch and scaling with just $5M. Cleantech companies adopting this approach generate $8-10M in Year 1 revenue by shifting to service-based delivery, thereby minimizing upfront hardware costs. Bayer’s endorsement accelerates market adoption, slashing entry barriers and further reducing needs—proving efficient growth without traditional funding bloat. Invest in this proven path to rapid ROI and sustainability.

In the EO sterilization industry, giants like Steris dominate with massive resources, deep pockets for R&D, established supply chains, and market influence—making it seem like smaller innovators could be easily crushed, outspent, or overshadowed, especially when sustainable solutions demand rapid scaling against entrenched players.

Relying solely on brute-force resources leaves companies vulnerable: Steris’ traditional methods face escalating regulatory scrutiny, environmental backlash, and inefficiency costs, risking obsolescence in a shift toward sustainable investing. Without breakthrough tech, even resource-rich firms struggle to adapt, leading to lost market share, compliance fines, and missed opportunities in a $16.78B growing sector—potentially stranding billions in outdated infrastructure while nimble competitors redefine the game.

Steris can’t match our proprietary clean technology recovery system, safeguarded by 10 global patents, including Japan (JP7410302B2) and the UK (GB2606910B). Through sustainable engineering and ultra-clean tech, we’ve pioneered a new category in environmental engineering, ensuring they can’t duplicate our efficiency and eco-compliance advantages. Todd Powell from Bayer validates our unique position, affirming how our solution secures the healthcare supply chain’s future—empowering sustainable growth without resource wars. Join us to lead the transformation.

In the high-stakes cleantech industry, skepticism arises when founders appear to lack the battle-tested experience needed to commercialize innovations—potentially leading to unproven strategies that fail to scale sustainable technologies like EO sterilization amid regulatory demands and market competition.

Without demonstrated expertise in launching ventures and managing complex teams, startups face devastating pitfalls: inefficient resource allocation, failed funding rounds, regulatory noncompliance, stalled product adoption, and eroded investor trust—resulting in billions of dollars in untapped potential as environmental solutions languish and competitors dominate.

CEO Nick Duff, with 14+ years in mechanical engineering and leadership, co-founded Pure Prime Solutions, authored a 73-page business plan with 163 citations, holds co-inventor credits on US patents 10,738,020 B2 and 10,815,209 B1 (plus global approvals in 7 countries), raised initial funding in 2020-2021, and led cross-functional teams at Lockheed Martin, Kratos Defense, and Cummins—achieving 45% cost reductions, 51% fewer prototypes, and 37% faster testing. CTO

Tom Cushing, with 15+ years of experience in mechanical engineering, including as an Engineering Manager at American Air Filter (a Daikin subsidiary) and Director of Engineering at Mueller Environmental, excels in ASME-compliant designs, product launches, and industrial automation.

Their combined veteran service, successful exits from prior roles, digital twin and simulation expertise, and deep networks in healthcare/manufacturing—endorsed by Bayer’s Director of Sterility Assurance—elevate us beyond typical startups for assured commercial success.

In the competitive cleantech landscape, particularly for innovations like EO sterilization, the lack of clearly identified strategic buyers capable of $100M+ acquisitions raises red flags—signaling potential exit challenges that could undermine investor confidence and limit scalability amid tightening environmental regulations.

Without pinpointed acquirers, companies face prolonged uncertainty: diminished valuations, stalled funding rounds, regulatory non-compliance risks, and missed synergies in a market projected to reach $16.78 billion by 2030. This vulnerability exposes ventures to competitive erosion, where giants outpace smaller players, potentially squandering billions in sustainable opportunities as global demands for eco-friendly solutions intensify.

We’ve strategically identified powerhouse buyers eager for clean tech: Steris ($23.82B market cap), Johnson & Johnson ($373.35B market cap), 3M, and Bayer (who already endorses our solution). Our robust global patent portfolio—spanning Europe (EP4090653A4), Australia (AU2020423106B2, AU2022268302B1), and beyond—amplifies acquisition appeal by securing exclusive environmental engineering edges. Recent cleantech and sterilization exits, such as Sotera Health’s acquisition of Iotron Industries to expand EO capabilities, and broader M&A trends with 918 global startup deals in H1 2025, validate premium valuations—positioning us for seamless, high-ROI integrations in sustainable investing. Let’s discuss unlocking your stake in this future.

In essential industries like healthcare sterilization, EO processes are labeled “bad” due to environmental risks, prompting debates: optimize the existing method or replace it entirely? This choice is critical as EO remains irreplaceable for 50% of medical devices, yet mounting regulations demand action without disrupting vital supply chains.

Replacement sounds ideal but often fails: alternatives like gamma radiation, hydrogen peroxide plasma, supercritical CO2, or nitrogen dioxide lack EO’s penetration for complex, heat-sensitive devices, require expensive revalidation, massive equipment overhauls, and face scalability issues—leading to supply shortages, skyrocketing costs (up to 20-50% higher), regulatory hurdles, and potential health crises as no single substitute matches EO’s scope, risking billions in market value and compliance fines amid global sustainability mandates.

Embrace optimization: Our clean technology renders the indispensable EO process fully sustainable, delivering a 99.99% reduction in emissions via cutting-edge sustainable engineering—far exceeding replacement viability without infrastructure upheaval. Todd Powell, Sterility Assurance & Microbiology expert formerly at Bayer, affirms our solution “ensures future viability” of the healthcare sterilization supply chain. Through value engineering, we preserve critical assets while surpassing environmental goals, driving cost savings and seamless adoption for a resilient future.

Ready to optimize? Let’s connect.

In the cleantech space, bespoke engineering for solutions like EO recovery is seen as non-scalable—requiring tailored designs for every facility, which balloon engineering efforts, timelines, and costs while restricting broad adoption across diverse healthcare settings.

This customization bottleneck creates vicious cycles: escalating per-unit expenses, fragmented deployments, and inability to capture market share in a $16.78 sector surging at 10.7% CAGR, leading to investor skepticism, regulatory roadblocks, and competitive wipeouts as agile, standardized players dominate—potentially stranding innovative tech and forfeiting billions in sustainable revenue.

Transform the paradigm with our Equipment-as-a-Service (EaaS). Like Uber’s fleet serving endless riders, each recovery unit becomes a yield-generating asset across multiple facilities, pivoting from single-sales to networked efficiency. Digital engineering powers mass customization without rework, amplified by CTO Tom Cushing’s 15+ years in smart factory expertise—including global design software and data management at American Air Filter (Daikin subsidiary) and industrial automation leadership at Mueller Environmental—ensuring seamless scaling for varied deployments.

Our modular cleantech adapts effortlessly to 10-bed or 1000-bed sites, distributing development costs across the green supply chain, as seen in proven cleantech EaaS like emission monitoring and precision farming.

Ready to scale sustainably? Let’s partner.

In the evolving landscape of sustainable manufacturing, doubts persist that the market isn’t primed for clean technology innovations like EO recovery—deemed “too early” amid lingering reliance on traditional methods and perceived regulatory leniency.

This hesitation is costly: as EPA regulations tighten, non-compliant facilities risk hefty fines (up to $50,000 per day under Clean Air Act violations), operational shutdowns, supply chain disruptions in healthcare, and reputational damage in an era where sustainability mandates are non-negotiable—potentially forfeiting billions in a $16.78B market while competitors who act early secure dominance and avoid escalating enforcement pressures.

The market is ready now: EPA’s 2024 final rule slashes EtO emissions from sterilizers by 92%, with 2025 updates enforcing risk reductions and extending compliance timelines to April 2028, compelling swift adoption of clean tech or face penalties. Our global patents—Canada (CA3229924A1, CA3159301A1), Europe (EP4090653A4), and Asia (JP7410302B2)—perfectly align us for international rollout. Bayer’s endorsement validates readiness, noting our solution “ensures future viability” of sterilization chains. Early investment in our cleantech yields instant competitive edges through compliance, security, and sustainable gains—let’s capitalize today.

In the volatile EO sterilization industry, where handling hazardous materials invites accidents, emissions, or lawsuits, a lone incident can spiral into existential disaster—wiping out operations, draining capital, and leaving investors exposed without layered protections.

This risk is stark: Sterigenics faced a $408M settlement in 2023 for over 870 EO exposure lawsuits in Illinois, followed by $34M for 129 claims and $30.9M for 97 claims in 2025, amid community backlash and facility pressures. EPA’s 2024 rule mandated 92% emission cuts at nearly 90 facilities, triggering fines like California’s $800K+ penalty for worker exposure at Parter Medical, with closures and remediation costs soaring into millions—illustrating how one event can bankrupt firms, erode investor trust, and halt industry progress.

Rest assured: PPS’s C Corporation structure inherently limits liability, isolating risks per deployment to protect core investor capital. Comprehensive insurance—encompassing pollution liability, general liability, and operational coverage—insulates each facility against incidents. Our patented EO solution actually mitigates client liabilities versus traditional methods, achieving a closed-loop system with 99.99% recovery that prevents releases and transforms high-risk processes into compliance advantages. Safer environmental engineering, supported by global patents including UK (GB2606910B) and South Africa (ZA202205538B), eliminates regulatory hurdles with designs aligned to FDA standards and international certifications. Separate legal entities for deployments prevent chain reactions, while Bayer’s endorsement from Todd Powell enhances credibility—shifting the narrative from emission liabilities to sustainable savings and long-term security.

Let’s secure your investment today.

We only send relevant updates you’ve opted into—unsubscribe anytime.

Your details are encrypted and compliant with GDPR and CCPA standards.

You will receive a confirmation and a meeting link via email.

We receive your details as soon as you submit the form.

A thank-you page confirms your submission was successful.

We’ll email a link to book a consultation (check spam if needed).

Information provided for informational purposes only. Not an offer to sell or solicitation to buy securities. Investment decisions require thorough due diligence and consultation with qualified financial, legal, and tax advisors. Past performance and projections do not guarantee future results. Early-stage investments involve substantial risk, including the potential for total loss of capital.